The EPFO has come up with an online withdrawal facility, which has made the entire process more comfortable and less time-consuming.

To apply for the withdrawal of EPF online through the EPF portal, make sure that the following conditions are met:

1. The Universal Account Number (UAN) is activated, and the mobile number used for activating the UAN is in working condition.

2. The UAN is linked with your KYC, i.e. Aadhaar, PAN, bank details, and the IFSC code.

If the above conditions are met, there is no need for attestation through previous employer for your withdrawal application.

Step 1: Visit the UAN PORTAL

Step 2: Log in with your UAN and password. Enter the captcha and click on the Sign In button.

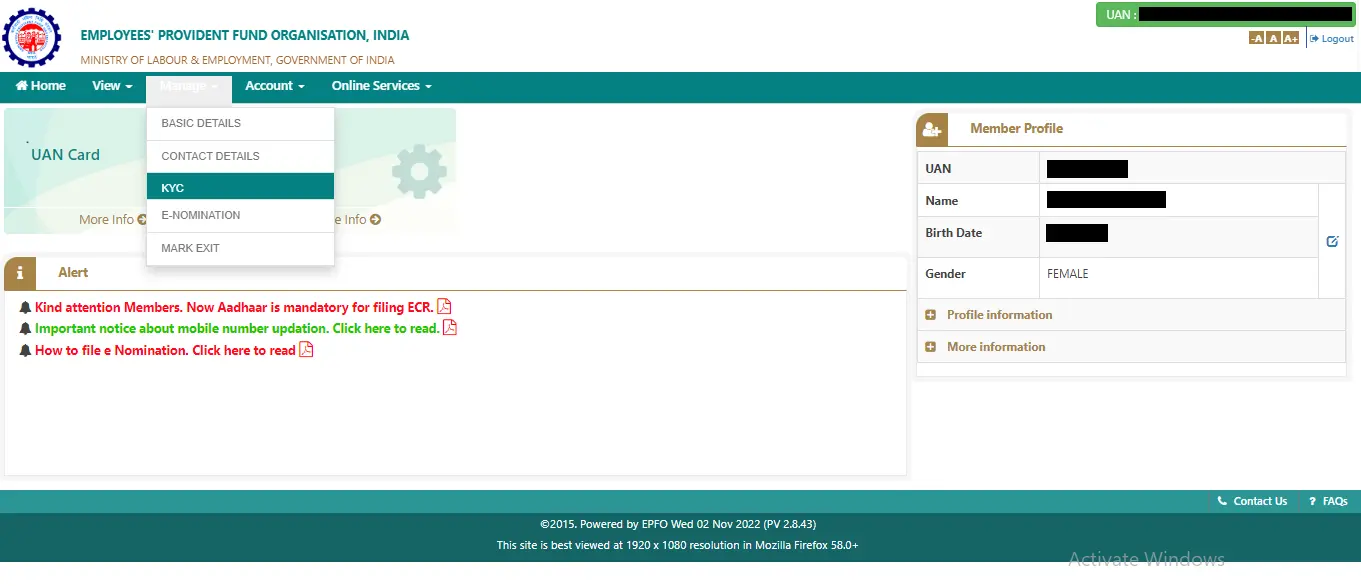

Step 3: Click on the Manage tab and select KYC to check whether your KYC details such as Aadhaar, PAN and bank details are verified or not.

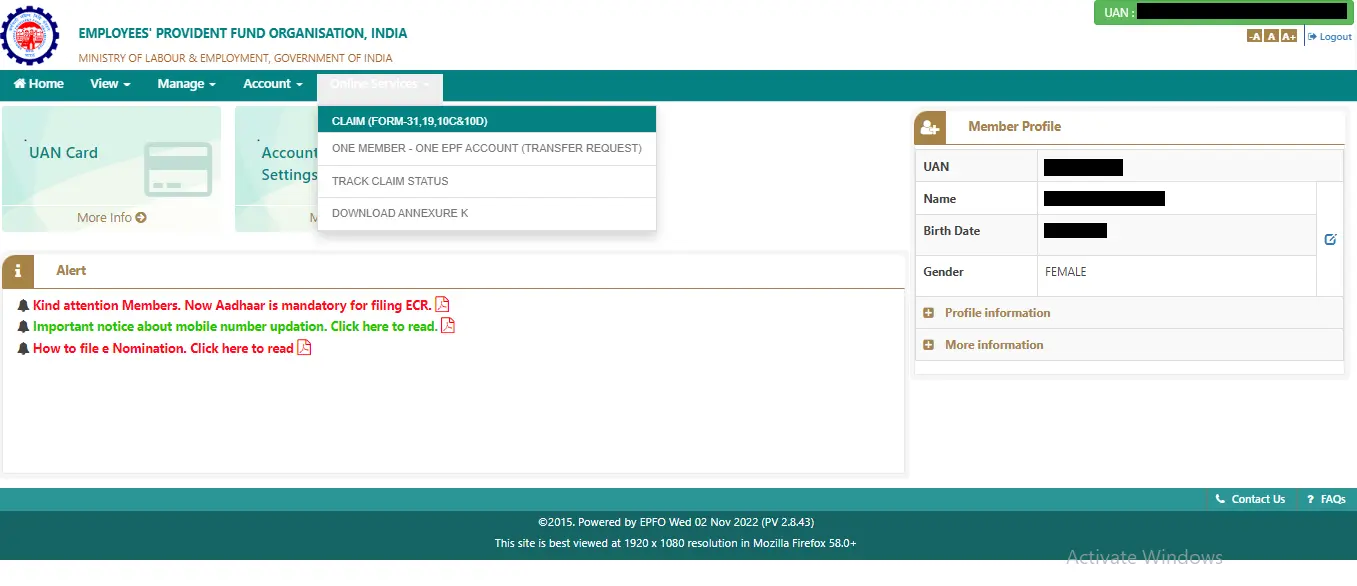

Step 4: Once the KYC details are verified, go to the Online Services tab and select the option Claim (Form-31,19,10C&10D) from the drop-down menu.

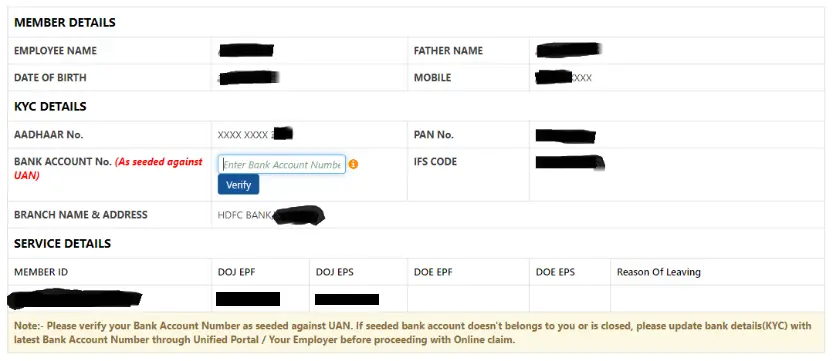

Step 5: The following screen will display the member details, KYC details and other service details. Enter your bank account number and click on Verify.

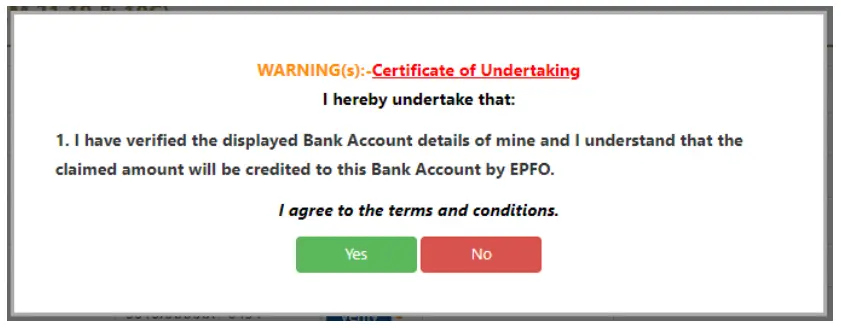

Step 6: Click on Yes to sign the certificate of the undertaking and then proceed.

Step 7: Now, click on Proceed for Online Claim.

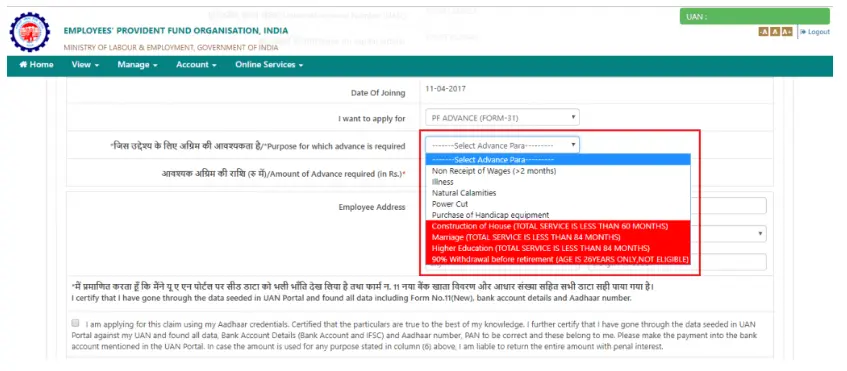

Step 8: In the claim form, select the claim you require, i.e. full EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal, under the tab I Want To Apply For. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal due to the service criteria, that option will not be shown in the drop-down menu.

Step 9: Then, select PF Advance (Form 31) to withdraw your fund. Further, provide the purpose of such advance, the amount required and the employee address.

Step 10: Click on the certificate and submit your application. You may be asked to submit scanned documents for the purpose you have filled the form.

The following documents are necessary to withdraw PF amount:

a. Universal Account Number (UAN)

b. Bank account information of the EPF subscriber

c. Identity and address proof

d. Cancelled cheque with IFSC code and account number

Stay informed with the latest updates and exclusive insights weekly!